Financing Strategies for Business Survival During COVID: PPP, Loan Forgiveness, Lender Discussions & Managing Cash

PPP - Look Beyond Paycheck Protection Program Loans – 4 Steps to Take Now Beyond PPP to Loan Forgiveness

By Jeff Bardos, CEO, Speritas Capital

April 15, 2020 – Greenwich, Connecticut

Call or text Jeff at 203-247-4358

Schedule a Call

Email Jeff

UPDATE: SBA notice – The Paycheck Protection Program (PPP) ended on May 31, 2021. Existing borrowers may be eligible for SBA PPP loan forgiveness

First and foremost, I hope you are as well as you can be, both mentally and physically. We’re all facing multiple challenging situations. Keeping your business running, or simply afloat, is a daily struggle despite the launch of numerous federal and local programs.

I’ve been working hard to help clients assess their financing options in this extremely challenging time. Most businesses are focused on SBA Paycheck Protection Program loans but there is more to the financing puzzle than PPP.

We’re recommending that our clients take the following immediate steps as they look beyond PPP:

Assess Your Ability to Leverage Hard Assets

Find & Explore City, State and Federal Relief Programs

Get in Line for a Paycheck Protection Program (PPP) Loan

Watch for Details for the Federal Reserve’s Main Street Lending Program, coming soon.

1. Assess your ability to leverage hard assets.

We’re helping clients determine if they have additional liquidity “hidden” on their balance sheet. ABL lenders, factors and commercial real estate lenders are open for business (although they are more conservative these days.)

Accounts receivable, inventory, machinery & equipment and real estate can be leveraged quickly. Consider purchase order finance to free up working capital to support existing orders.

2. Find state and local financial relief programs.

Some states and municipalities have created economic incentive programs to provide immediate relief. The Council for Community and Economic Research’s State Business Incentives Database is a useful starting point for identifying state programs.

Local small business development centers (SBDCs), funded in part by the SBA, can help you navigate both SBA loan programs and state and local relief programs. Also look for Women’s Business Development Centers.

3. Get in line for a Paycheck Protection Program loan if you haven’t yet.

Businesses without a credit relationship with a traditional lender have limited options. Some with bank relationships have been shut off anyway.

A few bank and nonbank lenders are taking—and processing—PPP applications from new customers and more are coming online each day as the SBA sorts out their process for approving new lenders.

We have access to direct PPP lenders with capacity for new clients. The process is cumbersome, but we are making progress on behalf of our clients. Contact me today if you need PPP help.

4. For businesses too large for PPP, watch for details of the Fed’s Main Street Lending Program.

This new loan program will provide funding for a broader range of businesses by focusing on mid-sized businesses with up to 10,000 employees or $2.5 billion in 2019 annual revenues. The Federal Reserve is seeking comments on this program until April 16, 2020.

Three Critical Coronavirus Finance Planning Steps to Take Now During the COVID-19 Crisis

Keeping your family and your employees safe is clearly your first priority right now as a business owner. Once you have that under control, I recommend that you focus on 3 critical financing areas to keep your business afloat:

Cash flow Management

City, State and Federal Support

Lender Relationships

Manage Cash Flow Prudently

Treat each dollar in your operating account as if it were your last. Manage vendor relationships and operating expenses carefully, reducing anything which can be viewed as discretionary in this environment.

Develop a daily 90-day cash flow forecast with a couple of scenarios and update your projections frequently as this crisis unfolds.

Look for City, State and Federal Support

Start with a determination if your state and your business qualify for an SBA Disaster Assistance Loan. These loans are provided directly by the SBA, not through private lenders. You can get the details and apply at this SBA disaster loan info link.

Each state has business and economic development agencies, and many are offering direct support to small businesses impacted by COVID-19. You can search for resources for your state at this federal economic assistance link.

Make sure you follow the Federal Government efforts to provide economic and tax relief to small businesses. The components of the relief package change daily, but be sure you’re up-to-date on what may become available to you.

Talk to Your Lenders

In times of stress, the natural tendency is to avoid your lenders. But the better approach is to engage your lenders early and be transparent about how you’re being impacted by the economic shutdown.

Some lenders have provided temporary payment relief and most lenders are open to some type of forbearance. The key is to engage them early and to provide full transparency about the steps you’re taking to address any weakness. If you have current debt, this is the key to your successful Coronavirus finance planning efforts.

Preparing for Short-Term & Long-Term Economic Weakness as a Result of COVID-19 Disruptions

These are difficult times for all of us, personally and professionally.

On the professional front, businesses are facing uncertain customer demand, difficult supply relationships, and tight cash flow issues. Business owners need to consider the cash flow implications if this economic weakness lasts longer than currently anticipated.

Lenders may show some flexibility in enforcing loan agreements.

The federal bank regulators have urged supervised banks to “work constructively with borrowers.”

The Coronavirus Preparedness and Response Supplemental Appropriations Act (H.R. 6074) signed into law last week provided the SBA with a small amount of support, likely funneled through their disaster loan program.

Hopefully, this flexibility and support will provide meaningful relief to businesses managing very tight working capital situations.

The good news is the cost of borrowing has gone down.

The Fed cut short-term interest rates by one-half of a percent and as a result LIBOR-based and Prime-based lending rates have fallen. These rate cuts affect not only asset-based lending, but term real estate and SBA loan rates too.

Asset-based lending, including accounts receivable, purchase order, and inventory financing are effective ways to leverage business assets during tight cash times. M&E and real estate collateral can be used to generate term loans as additional sources of cash infusions.

How Greenwich, CT-based Speritas Capital Partners can help.

Speritas Capital is eager to help clients navigate through this crisis. We’re happy to review cash flow projections, review SBA Disaster Loan applications, and discuss lender strategies. Our advice is always free.

We’re always available to discuss financing options. ABL, accounts receivable, purchase order and real estate financing can be quick and useful options in this challenging environment.

Feel free to schedule a call with me or call/text me directly at 203-247-4358.

Additional Related Reading:

Read more about all your Asset Based Financing options

Read the Pros and Cons of Accounts Receivable Financing

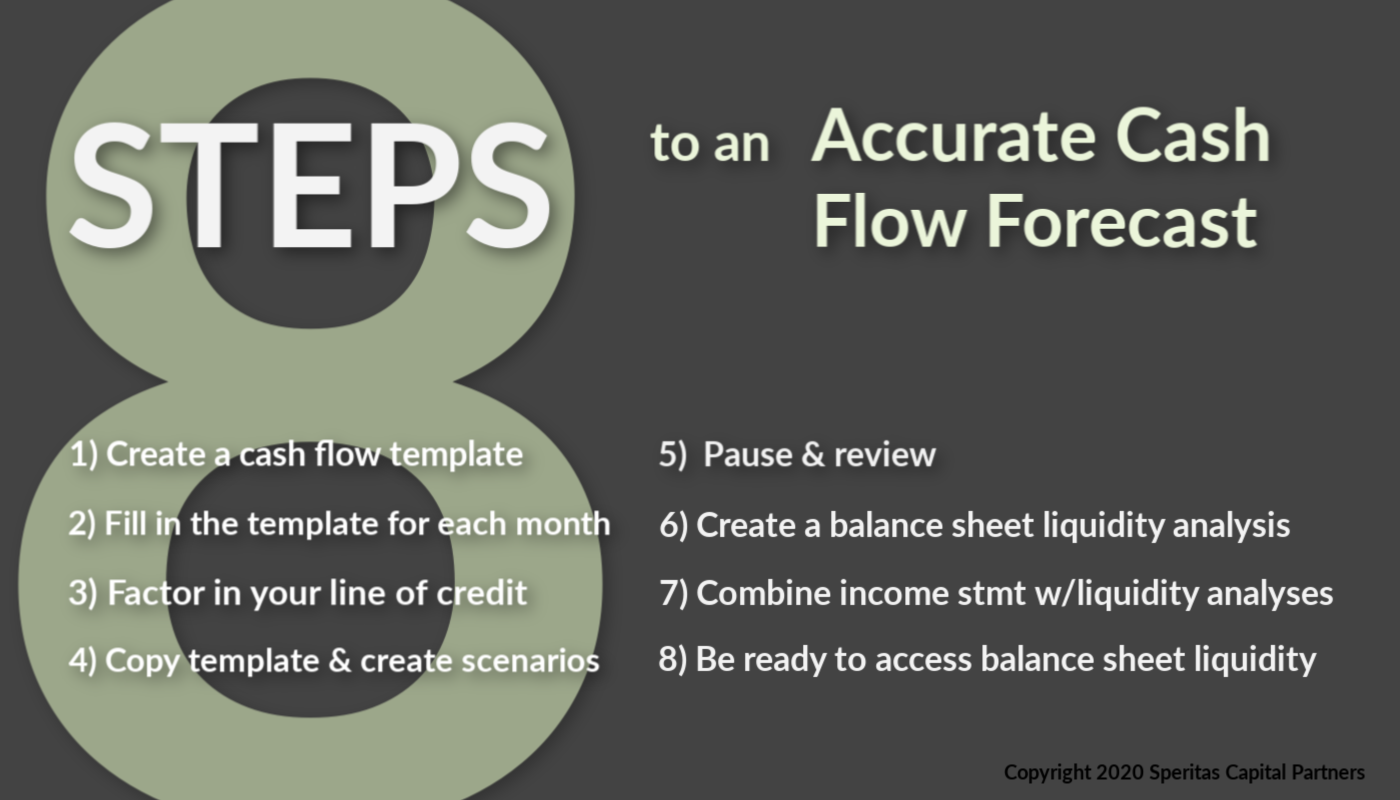

Read 8 Steps to an Accurate Cash Flow Statement (with template).

About the Author

Jeff Bardos, CEO, Speritas Capital Partners

Jeff has over 30 years of experience in the financial services industry. After graduating from the Columbia Business School, he joined the New York Federal Reserve Bank as a senior staff member in Bank Supervision, leading the Bank Analysis department. From the nation’s central bank, Jeff moved into the private sector, working at senior levels in commercial banking, retail banking and risk management. He has also played senior founding roles in several start-ups. Learn more about Jeff.

CONTACT INFO

Jeffrey Bardos

CEO Speritas Capital Partners

Call/text Jeff at 203-247-4358

Email Jeff with your financing questions

Schedule a call with Jeff using our online scheduling tool.

Speritas Capital Partners specializes in complex credit, collateral and cash flow situations and we never take upfront fees.

Because Speritas Capital is a debt advisory firm, we have access to a wide variety of asset-based lending structures. We’re not beholden to any one lender or structure so we can use our creativity and experience to design a structure that truly fits the needs of our clients.