The Pros and Cons of Accounts Receivable Financing

By Jeff Bardos, CEO, Speritas Capital Partners

May 22, 2020 – Greenwich, Connecticut

Call or text Jeff at 203-247-4358

Schedule a Call

Email Jeff

There are many advantages to using Accounts Receivable financing to fund your company’s growth, but there are also some perceived cons. Let’s talk about both.

But First…What is Accounts Receivable Financing?

Receivables financing is a process by which your company sells some or all of its commercial invoices to a factoring company at less than face value, in exchange for a quick infusion of cash which can be used for any business purpose.

What are the Pros of Accounts Receivable Financing?

The benefits of accounts receivable financing include:

AR provides a fast infusion of cash

Financing is discretionary

Collateral is unnecessary

You retain business ownership

Fast Infusion of Cash

The immediacy and seasonality of business requirements is such that term loans are simply unsuitable to satisfy some liquidity needs. Expenses such as payroll, inventory purchases, manufacturing inputs and business expansion all require prompt and responsive action.

Accounts receivable financing can be setup in less than a week. Ongoing transactions can occur within a day or two, to keep a steady cash flow to support your business.

Businesses can get an advance on invoices as soon as the buyer agrees to pay. So instead of waiting 30, 60, 90 or even 120 days for customer payment, factoring provides cash immediately.

Discretionary Financing

Unlike term financing, business owners retain the flexibility to choose the timing and amount of accounts receivable financing.

When cash flow is adequate, you can retain your receivables and wait for customers to pay on regular terms. When cash flow is tight, you can sell the amount of receivables required to cover upcoming expenses.

You may pay a receivables management fee, but that is generally far less than paying monthly principal and interest on a loan.

Collateral is Unnecessary

If you apply for a conventional bank loan, you’ll usually have to provide some form of collateral as security for the lender.

In accounts receivable financing, the invoices themselves are the collateral, so there is no need to provide any other form to a factoring company. This means that no business assets are not jeopardized, and your personal assets are not exposed.

You Retain Business Ownership

When a company has critical need of financing, one of the ways it can raise cash is to sell equity in the business, and while that may be effective, it relinquishes some degree of control in your business.

When you arrange for accounts receivable financing, you retain complete control of your business, because no other investors are involved.

Questions? Schedule a call with the author, Jeff Bardos, email, or call/text him at 203-247-4358.

Cons of Accounts Receivable Financing: Issues to consider

The possible disadvantages of accounts receivable financing include:

AR has costs & fees (like most funding options)

Customers could be confused by paying an ‘intermediary’ (the factoring company)

The need for creditworthy receivables (some receivables won’t qualify).

Costs & Fees

The factoring company purchases the receivables at a discount the receivable’s face value.

The discount is essentially the cost of getting paid early and is comparable to the cost of offering standard early payment terms directly to your customers.

Customer Confusion

In most cases, your customer will be notified by the factoring company to direct payments to the factoring company. You may need to explain the process to less sophisticated clients.

However, most companies and their CFOs and accounting departments are familiar with this process and can handle such requests easily.

Some Receivables Won’t Qualify

Accounts receivables must be free and clear of any liens so that the factoring company can buy the receivables outright.

If your receivables are subject to a blanket lien from another lender, that lender will need to carve the receivables out of their lien. Most lenders are familiar with this process and will work with you.

Your receivables must also be from credit worthy customers. The parameters will be set by your lender.

Deciding if Accounts Receivable financing is the right direction for your company can be complicated and it’s easy to choose the wrong lender. Good operations and a great back office is especially important in AR financing. Speritas Capital is here to help you think through your funding options, review your assets, and connect you with the right financing partner.

Schedule a call with the author, Jeff Bardos, email, or call/text him at 203-247-4358.

Additional Related Reading:

Read more about all your Asset Based Financing options.

Read the Beginners Guide to Asset Based Lending.

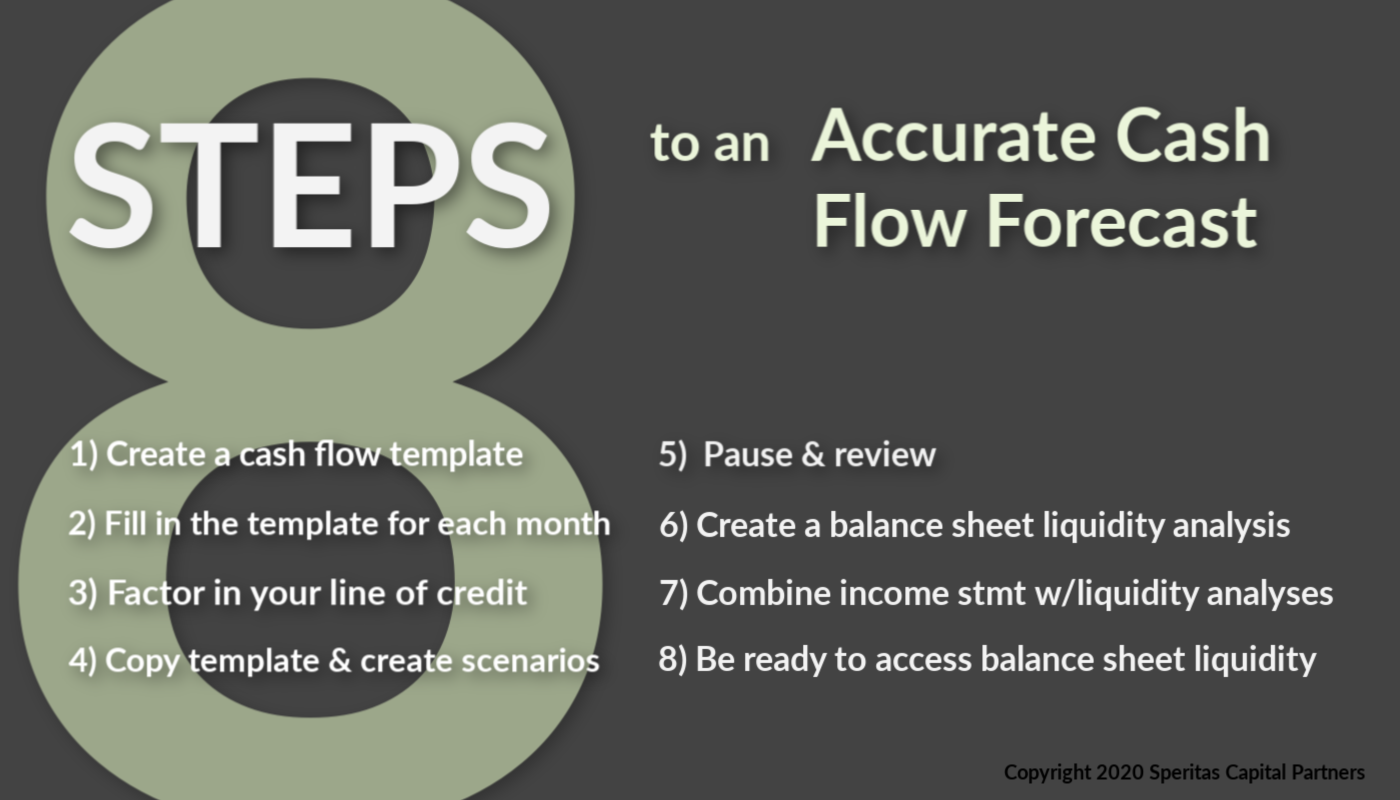

Read Liquidity Planning: 8 Steps to an Accurate Cash Flow Statement (with template).

About the Author

Jeff Bardos, CEO, Speritas Capital Partners

Jeff has over 30 years of experience in the financial services industry. After graduating from the Columbia Business School, he joined the New York Federal Reserve Bank as a senior staff member in Bank Supervision, leading the Bank Analysis department. From the nation’s central bank, Jeff moved into the private sector, working at senior levels in commercial banking, retail banking and risk management. He has also played senior founding roles in several start-ups. Learn more about Jeff.

CONTACT INFO

Jeffrey Bardos

CEO Speritas Capital Partners

Call/text Jeff at 203-247-4358

Email Jeff with your financing questions

Schedule a call with Jeff using our online scheduling tool.

Speritas Capital Partners specializes in complex credit, collateral and cash flow situations and we never take upfront fees.

Because Speritas Capital is a debt advisory firm, we have access to a wide variety of asset-based lending structures. We’re not beholden to any one lender or structure so we can use our creativity and experience to design a structure that truly fits the needs of our clients.