Loan Covenants Explained: How to Review & Negotiate Covenants to Avoid Covenant Breaches

By Jeff Bardos, CEO, Speritas Capital

January 19, 2021 – Greenwich, Connecticut

Call or text Jeff at 203-247-4358

Schedule a Call

Email

My Experience with Commercial Loan Covenant Negotiation

In my experience as a debt advisor, I’ve seen many cases where loan covenant breaches have caused irreparable financial damage to a business. And breaches often take borrowers by complete surprise.

You need funding that helps, not hurts, your business. So be sure to have your counsel and your debt advisor review your loan covenants before you sign.

Careful review gives you a better chance of negotiating more favorable covenant terms, or to find alternative sources of funding.

The Right Way to Approach Loan Covenants & When to Negotiate

Let’s take a look at Robert – a business owner who was smart about looking at his loan terms & conditions in detail before signing on the dotted line.

Robert owns a profitable manufacturing firm and successfully negotiated with a local bank for additional growth financing.

He sent the bank’s term sheet, which outlined the interest rate and maturity and the main terms and conditions, to his legal counsel for review. Everything looked pretty good.

Then came the loan documents (87 pages) which contained even more detailed terms and conditions.

Robert’s counsel had concerns.

Many of the terms and conditions seemed to give the lender unwarranted and unusual control over the business if a condition or covenant were breached.

Robert and his counsel weighed the benefits of this critical new financing against the potential to lose control.

What if there was a seasonal or other temporary downturn in company performance? Would the lender impede or prevent a recovery based on a covenant breach?

Robert needed financing to grow, but he began to question whether this loan would support the company’s long term goals.

This is the loan review process that every borrower should undergo. And this is the ideal stage to negotiate your covenants. Before you sign and definitely NOT after a breach!

If you’re aware of your covenants, and understand the consequences of a breach, you’re in better shape than many borrowers.

Best practices are to put processes in place to track your performance against your covenants so that you’re not taken by surprise.

Loan Covenant FAQ – The Top 6 Things You Should Know About Covenants

Where would I find covenants in my loan?

Covenants are generally found in the loan documents in the detailed ‘terms and conditions’ section. They could be anywhere so read carefully!

What kind of loans are most likely to have covenants?

Loan covenants are found in most but not all loan agreements. You will almost always find them in business lending and in commercial real estate financing.

What is the worst that could happen to my company if a covenant is breached?

Some covenants, if triggered, could prevent your company from getting additional financing, demand immediate loan repayment, or force your company to sell assets at fire sale prices.

Am I able to get additional financing if I’ve breached a covenant?

Most traditional lenders will not provide additional funding if you’ve breached a covenant of your loan. Non-traditional, private lenders may be willing to refinance a loan in breach.

Can I negotiate loan covenants to protect my business from a breach?

Borrowers may not be able to eliminate certain covenants, but they may be able to negotiate when a covenant would be breached, giving the company more operating flexibility to weather a downturn without the lender gaining control.

Who should review & negotiate loan covenants?

Borrowers will rely primarily on their legal counsel to review and negotiate loan covenants. You can also use your debt advisor or loan broker to help determine a negotiation strategy. They’ll know what is customary in your particular situation, loan type and industry.

Breaches and their Consequences

Rigid covenants can allow a lender to force a refinancing during times of stress. Here’s an example of a real-life covenant breach case.

Breach Example: Raw Materials Spike Leads to Loan Covenant Breach

A second-generation plastics manufacturer faced a huge spike in resin costs due to severe weather in their supply chain.

This increase in cost of goods could not be passed on to the consumer immediately because of competitive pressures.

The company breached its fixed charge coverage ratio and was in technical default on their asset-based credit facility.

Even though the disruption was temporary, the result was limited credit line availability, no financing for growth, and pressure from the lender to refinance the line with another lender ASAP.

Read more about how a new $27MM asset backed line of credit arranged by Speritas Capital solved a major covenant breach issue for a Massachusetts manufacturer.

Questions? Schedule a call with the author, Jeff Bardos, or call/text 203-247-4358.

Loan Covenants Explained

Covenants can be complicated and can cause serious trouble for borrowers. So let’s dig in, starting with the basics.

Loan covenants are designed to protect the lender against a change in the financial condition of the borrower.

A “breach” of a covenant is an event of loan default just like not paying the periodic principal and interest payments.

Loans with relatively low interest rates usually come with more covenants. This is a generalization, but banks usually provide the lowest cost of funds and attach the most covenants.

On the other extreme, hard asset lenders offer higher rates with few or possibly no covenants.

Now let’s look at the most common covenants.

Loan Covenant Categories

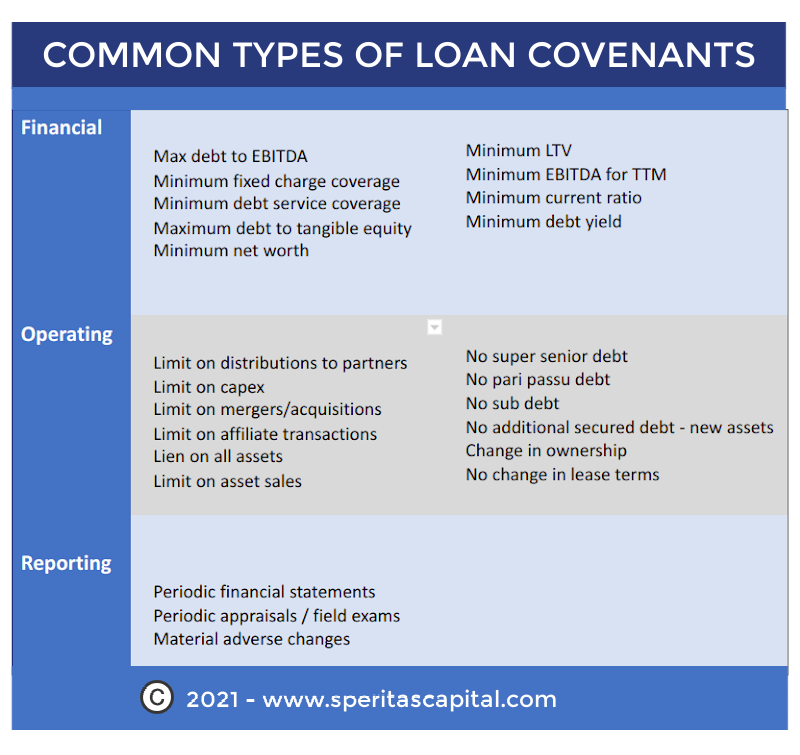

Covenants fall into 3 main categories:

Financial Covenants

Operating Covenants

Reporting Covenants

Within each category there are affirmative (the borrower will…) and negative covenants (the borrower will not…).

The table below lists common covenants by category. Most loan agreements have some, but not all, of the covenants listed in the table.

Larger deals will have more covenants. This makes sense because larger deals create more risk for a lender so lenders will try to add as many protections as they can.

Questions? Schedule a call now!

Common Financial Loan Covenants

Fixed Charge Coverage Ratio (FCCR)

This covenant requires the borrower to maintain free cash flow equal to or greater than fixed expenses. This covenant is measured on a trailing twelve-month basis at each required reporting period.

Free cash flow is measured by EBITDA (earnings before interest, taxes, depreciation and amortization) or EBITDAR (EBITDA before rent expense.)

Fixed charges include fixed expense commitments such as cash interest expense, scheduled principal payments, lease payments, capex, distributions made, minimum required contributions and other cash payments to employee benefit plans.

EBITDA / Fixed Charges ≥ 1.0-1.5 (common range)

Minimum Net Worth

This covenant sets a minimum absolute equity book value the company must maintain.

For companies with previous acquisitions, the covenant can be modified to minimum tangible net worth, which subtracts intangible assets like goodwill from net worth. Note that this covenant can apply to the company and to any guarantor.

Other common financial covenants include limits on balance sheet leverage (maximum debt to tangible equity) and minimum debt service coverage (EBITDA / total cash interest and principal payments.)

Common Operating Loan Covenants

Limits on Additional Debt from Other Lenders

Senior lenders will often restrict the borrower’s ability to borrow additional money even if the additional financing were junior or subordinated to the senior lender.

This restriction can be an issue for all types of financings. For example, a commercial real estate investor with an appreciated asset may want to increase the leverage on the property by borrowing on a subordinated basis.

The subordinated lender would only be paid principal and interest if the senior lender’s covenants were met. Even in this case, the senior lender may require their pre-approval and an intercreditor agreement which can be difficult to negotiate.

Capex financing and intercompany financing transactions may also be subject to lender approval or limits with these types of operating covenants.

All Asset Pledge Covenant

Borrowers should be particularly cautious about all asset pledges, which are fairly common. This is when a borrower agrees to an all asset pledge as a condition of the loan.

All assets could include accounts receivable, inventory and equipment, and also owner-occupied real estate. Be sure you know which assets are pledged!

A cash out refinancing of your real estate could be prohibited if the lender with the all assets lien doesn’t cooperate.

Limits on Asset Sales

This covenant establishes a limit on the amount of assets a borrower can sell, transfer or lease in a year. This term exists to protect the core assets which provide collateral for the loan.

Asset sale covenants may prevent a borrower from selling off assets during the normal course of business or restrict transfers among affiliates. A borrower may be forced to hold onto underperforming assets to satisfy these covenants and lower the returns on equity.

Limits on Asset Purchases – Some covenants require lender approval for any capex above a defined dollar amount per year.

Some covenants require the lender’s approval for any acquisitions or mergers.

What happens if your lender doesn’t agree with the strategic value of your planned acquisition?

Lenders must have a solid business reason for not agreeing to an acquisition, but do you want to be in that position? Possibly, but this needs to be assessed up front.

Questions? Schedule a call with the author now.

Common Reporting Loan Covenants

Reporting covenants vary widely, from borrowing base certificates to quarterly financial packages (balance sheet, income and cash flow statements). Reporting covenants can contain “springing” provisions in which reporting periods increase if a financial covenant were breached.

More restrictive reporting covenants permit the lender to conduct on-site inspections of a borrower’s books and records without advance notice.

A key issue to consider is the timing requirement for financial reports. The lender might demand quarterly statements within 21 days after quarter end, or annual reports within 60 days of fiscal year end.

Many small and lower middle market businesses take more time to close their books and finalize their periodic financial reports. Borrowers have to be careful not to commit to reporting time frames they cannot meet with accurate reports.

Loan Covenant Wrap-Up

Covenants are complex and their potential consequences hard to foresee. The impact of a breach will be felt by the borrower and by any loan guarantors.

Business owners must weigh the pros and cons of taking lower interest money against the potential to lose control of their business if things go badly.

Many borrowers focus on rate, maturity and credit availability, then they negotiate the terms, and then hope (pray?) they’ve made a financing choice which supports their long-term goals. Don’t be that borrower!

Seek the advice of experienced legal counsel and independent debt advisors to assess whether any covenants could hinder your daily operations, interfere with your strategic goals or endanger your business.

Reviewing the covenants in loan term sheets requires strategic foresight and attention to detail. Speritas Capital is here to help you think through your financing options and connect you with the right lender for your business/investment situation and goals.

Schedule a call with the author, Jeff Bardos, email, or call/text him at 203-247-4358.

About the Author

Jeff Bardos, CEO, Speritas Capital Partners

Jeff has over 30 years of experience in the financial services industry. After graduating from the Columbia Business School, he joined the New York Federal Reserve Bank as a senior staff member in Bank Supervision, leading the Bank Analysis department. From the nation’s central bank, Jeff moved into the private sector, working at senior levels in commercial banking, retail banking and risk management. He has also played senior founding roles in several start-ups. Learn more about Jeff.

CONTACT INFO

Jeffrey Bardos

CEO Speritas Capital Partners

Call/text Jeff at 203-247-4358

Email Jeff with your loan covenant breach questions

Schedule a call with Jeff using our online scheduling tool.

Speritas Capital Partners specializes in arranging financing for complex credit, collateral and cash flow situations - and we never take upfront fees.

Because Speritas Capital is a debt advisory firm, we have access to a wide variety of lending structures. We’re not beholden to any one lender or structure so we can use our creativity and experience to design a structure that truly fits the needs of our clients.