RECENTLY FUNDED | $2.5MM Revenue-based Credit Facility for an International SaaS Company

LOAN CASE STUDY: Speritas Capital Partners arranged a refinancing for a 12-year-old, founder-led CRM software provider targeting private equity firms, hedge funds, and family offices. The company sought to fuel growth by refinancing high-cost debt and consolidate multiple merchant cash advances into a single credit facility tied to its monthly recurring revenue (MRR).

THE SITUATION: Post-COVID issues and an expensive platform overhaul strained renewal rates and revenues for this SaaS company.

A major bank declined to renew the company’s revolving line of credit due to lack of profitability.

The double digit expense of four stacked MCA’s ate away at cash flow and profitability.

The founders needed lower monthly payments and fresh working capital to drive sales, marketing, and adoption of their second generation platform.

Speritas Capital crafted an engaging story of the co-founders’ deep expertise and, despite the challenging profitability status of the company, was able to engage the interest of several revenue-based, non-bank lenders.

Borrower Background

The Company has been building CRM software for over 12 years, serving private equity firms, hedge funds, family offices, and other investors in private companies.

The founders financed the early stages themselves, reinvesting capital into product development, customer support, and international expansion.

Their latest platform overhaul required significant R&D expenses while post-COVID issues dented renewal rates. Customer reaction to the new platform was very positive but the roll-out was in an early stage.

Loan Challenges

The company’s weak financial performance and limited financing options has led the Founders to access merchant cash advances at extremely high rates. These steep cost and fixed remittance structures hampered cash flow, hamstringing the company’s ability to grow and increase profitability.

Financial performance had improved only recently, with break-even MRR achieved after increasing renewal rates and cutting operating costs.

The Company had no tangible collateral—no accounts receivable, equipment, or real estate—and no private equity sponsorship. As a result, neither a bank nor an SBA loan was possible.

Only a handful of MRR lenders entertain sub-100% year-over-year growth profiles. Most MRR/SaaS lenders are focused on venture capital backed, high growth SaaS companies. These lenders look for high growth start-ups where the rapidly growing revenue mitigates the credit risk.

Speritas CEO Jeff Bardos knew that very few revenue-based lenders would be interested in a 12-year-old businesses with moderate growth.

So while we knew that revenue-based funding was the best product fit for our client’s situation, the challenge was to find a revenue-based lender that would even consider the deal and not charge MCA-like rates.

Speritas Capital Partner’s Role

The company founders were referred to Speritas Capital by a private equity investor we had worked closely with on an acquisition deal.

The co-founders of the company were experienced and presented well. Their industry experience, professionalism and up-to-date financials enabled Speritas Capital to move at speed.

Speritas Capital conducted exhaustive research and outreach to eight specialized revenue-based lenders, leveraging both new and past relationships.

We packaged the company’s turnaround story, responded to lenders’ questions, and negotiated an initial loan amount which not only paid off the company’s existing debt but added significant new working capital. We assisted with a fast, 35-day closing process which met the current bank’s deadline.

Speritas Capital added value throughout the process by carefully targeting and approaching lenders and establishing a secure deal process. We advised our client on structural issues and loan covenants.

The company escaped from expensive debt and gained the working capital needed to support a larger sales and marketing effort.

Revenue-based lending questions? Call or text 203-247-4358, send an email, or schedule a call now with Speritas Capital CEO, Jeff Bardos.

Our Bank Partner

A non-bank specialist in revenue-based funding was interested in considering the deal - one that specialized in SaaS companies.

The lender liked the business and understood the SaaS CRM space well. The lender was willing to size the loan at the amount needed, in part because the owners presented very well in calls and could quickly respond to all the lender’s questions. The lender also spoke to the company’s clients to confirm the value of the CRM platform.

The lender’s team valued the founders’ credibility and the business’s stable subscription model.

Speritas had an established relationship with this MRR lender, and CEO Jeff Bardos was impressed with how willing they were to listen and think creatively about how to get the loan done. They could also close very quickly to satisfy the expiration of the bank facility.

They delivered a $2.5MM facility—$2.1MM funded at closing, with $400K available upon reaching predefined MRR targets.

Deal Structure Highlights

Loan Type: Revenue-based Loan (based on MRR)

Lender: non-bank specialized MRR lender

Loan Amount: $2.5MM

Initial Funding: $2.1MM at closing

Additional Availability: $400K upon hitting predefined MRR milestones

Term: 5 year amortization

Early paydown options with early repayment incentives after year 1

Covenants: quarterly MRR floors and year-over-year growth targets

Closed in 35 days

Outcome & Client Feedback

The facility immediately replaced high-cost debt, reducing monthly outflows by over 25% and increasing cash for sales and marketing.

The Company’s new platform is gaining traction among mid-market private market participants, driving MRR growth back above pre-COVID levels.

“I can clearly see the value Jeff and Speritas Capital brought to the table. We could not have successfully closed this type of transaction without Jeff’s assistance and credit expertise.”

Are you looking for a strategic partner to advise you on your next financing challenge?

The Speritas Capital team is always happy to hear your story, learn more about your financing needs and answer your questions. We bring our 30+ years of banking experience and our transparent, strategic approach to every client and every deal, both large and small.

And we never take up front fees.

CONTACT INFO

Jeffrey Bardos

CEO Speritas Capital Partners

Call/text Jeff at 203-247-4358

Email Jeff with your ABL financing questions

Schedule a call with Jeff using our online scheduling tool.

More about Jeff

Jeff’s Insights for SaaS Founders Seeking MRR Funding

Be Prepared: Benchmark your MRR growth against lender thresholds for your broker or financial advisor before you or they do any lender outreach. You may not meet lender requirements. And this will streamline term negotiations.

Be Realistic: Structure draw triggers to align with realistic product launch and sales ramp timelines. Don’t be too rosy or you’ll trigger covenants.

Assess Options: Balance the trade-off between revenue-based cost of capital and dilution from equity rounds. Can you delay an equity round until you’re more profitable? (Revenue-based capital is more expensive than bank debt but it may be your only option.)

Ideal situation?: Explore hybrid financing solutions—partial revenue-based advances plus venture debt—to optimize flexibility.

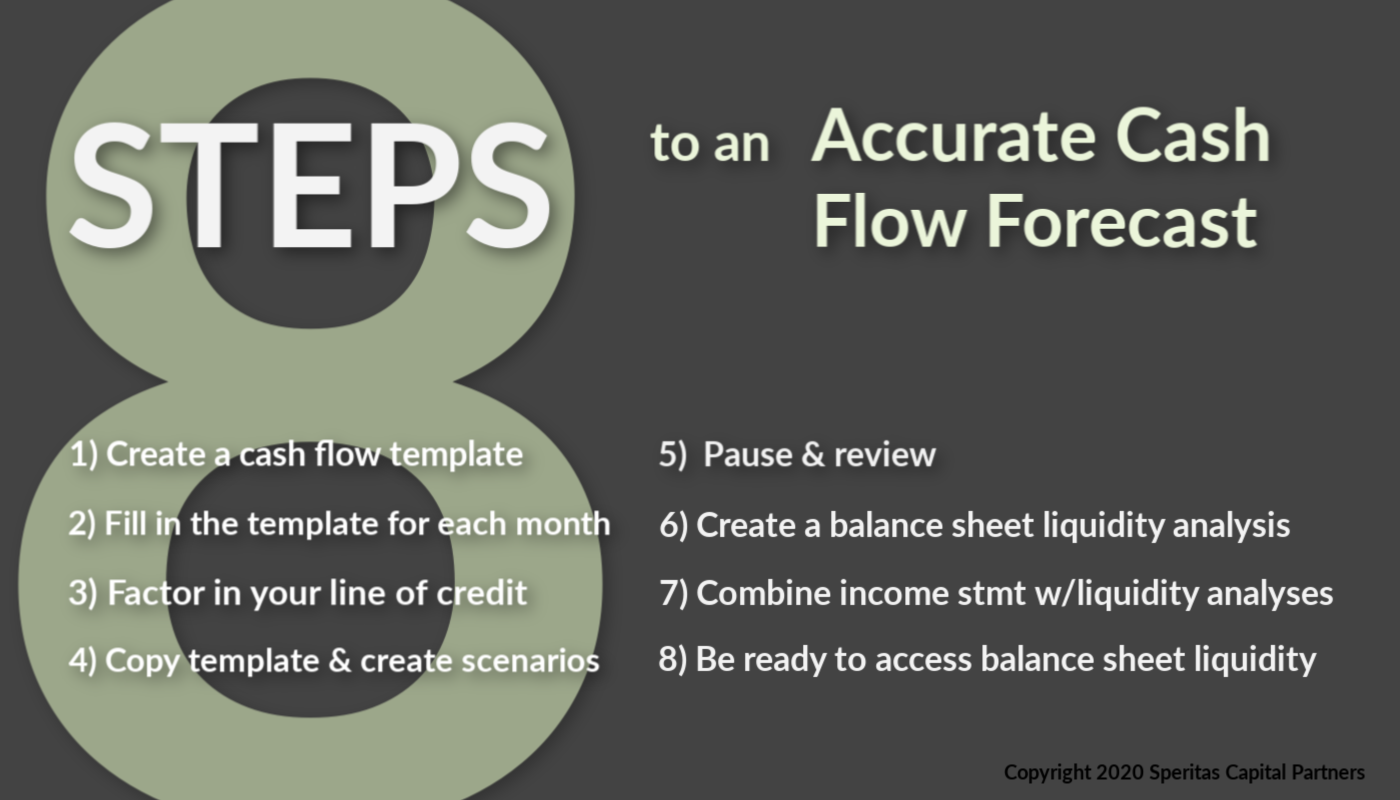

Be ship-shape and stay on top of your financial reporting and operations: Maintain a rolling 12-month financial model to demonstrate trending cash flow and justify covenants. Be ready to make adjustments as needed.

More Recently Funded Deals

Suggested Reading - Grab a beverage & take a seat by the fire or on the deck!

PRESS RELEASE

Speritas Capital Partners Arranges a $2.5 Million Closed Revenue-Based Facility for NYC SaaS Company

GREENWICH, CT — JULY 16, 2025 – Speritas Capital Partners today announced the closing of a $2.5 million revenue-based credit facility for a provider of a sector-specific, AI-driven customer relationship management system. Speritas Capital was brought in by the client to assess financing options to pay off their current lenders and to support substantial client demand.

This new facility refinanced a bank line of credit, eliminated expensive merchant cash advances (MCAs), and delivered vital working capital to support the expanded launch of the company’s 2nd generation CRM system.

Faced with limited lender options due to COVID-era setbacks and the capital demands of its second-generation platform, the company turned to Speritas Capital for strategic financing guidance. The debt advisory firm conducted an in-depth review of recent financials and monthly recurring revenue projections to develop a compelling narrative for prospective lenders.

“Our ability to assess the client’s financing needs and identify the right SaaS-based lender was critical,” says Speritas Capital’s CEO, Jeffrey Bardos. “We worked closely with the founders to develop a compelling story for potential lenders. “With limited tangible collateral and a fast-moving turnaround, this deal required creativity, clarity, and urgency.”

“The company was facing a looming liquidity problem when a close associate referred me to Speritas Capital,” noted the CEO of the client. “Jeff understood the complexity of our situation and moved swiftly,” said the client CEO. “He told our story powerfully, negotiated with precision, and sourced a lender who believed in our growth plan. We closed in just 35 days.”

###

About Speritas Capital Partners

Speritas Capital Partners, headquartered in Greenwich, CT, specializes in arranging customized financing solutions for small to lower middle market businesses and commercial real estate projects. With access to over 100 national lenders and private investors, Speritas focuses on complex credit, collateral, and cash flow challenges.

Financing solutions include:

Asset-Based Lending

Accounts Receivable & Purchase Order Financing

Equipment Finance

Revenue-Based Loans

SBA & USDA Guaranteed Loans

Bridge, Construction & Permanent CRE Loans

Scenarios supported include rapid growth, turnarounds, and acquisitions.