Creative Financing Options for Craft Breweries & Microbreweries

Let’s Explore Funding Options to Start or Grow your Craft Brewery

By Jeff Bardos, CEO Speritas Capital & Avid Home Brewer

April 21, 2021 – Greenwich, Connecticut

Call or text Jeff at 203-247-4358

Schedule a Call

Email

Throughout the country, the number of craft breweries and microbreweries continues to grow.

Demand for great craft beer is huge, but there have been some recent high profile closures and consolidations in the industry due to market saturation and under-capitalization.

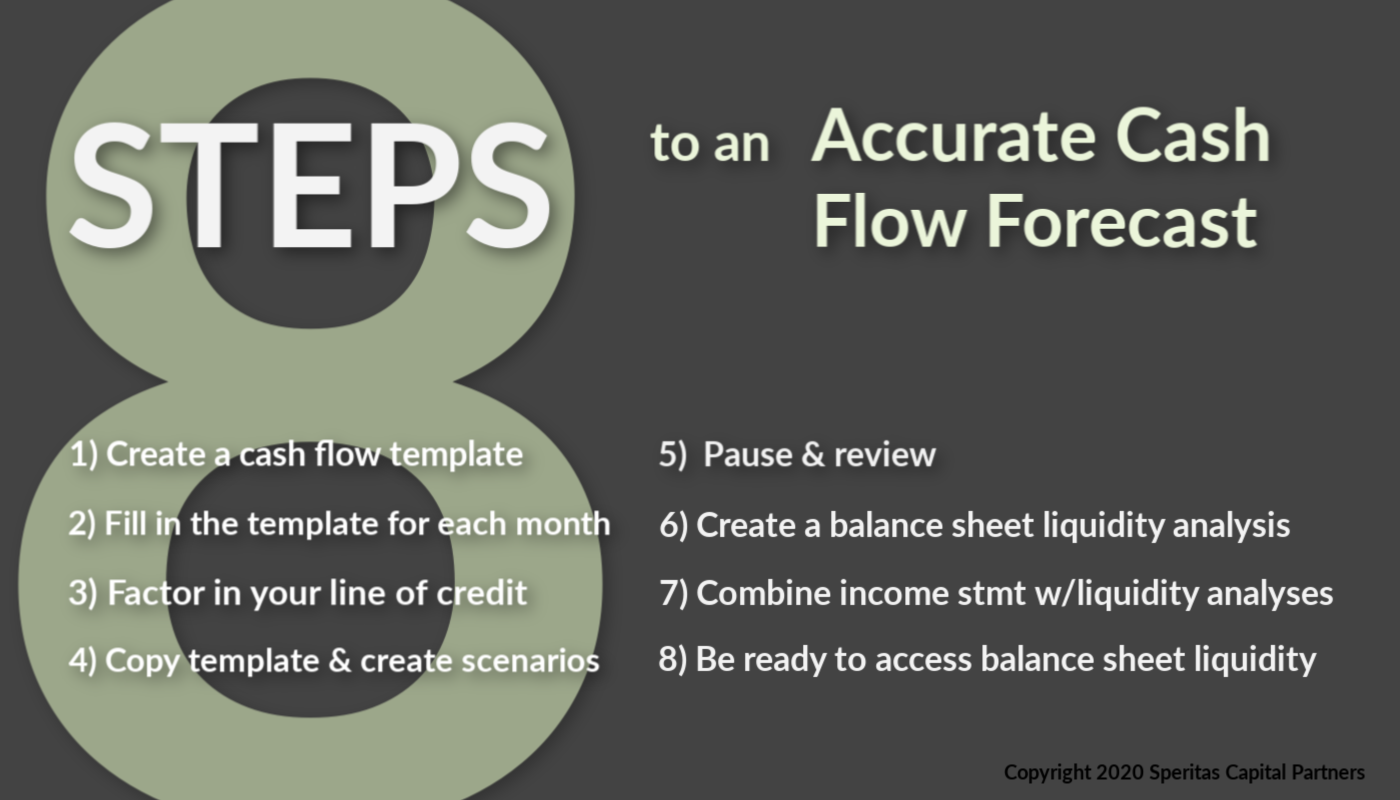

By financing strategically, and creating realistic financial projections and cash flow scenarios, you can increase the chance that your craft brewery can become profitable and grow.

Like every specialty industry, breweries have a unique set of equipment and financing needs which fall outside the loan programs offered by traditional lending institutions.

The good news is that a wide range of alternative financing options are available both for start up craft breweries and for growing breweries.

Let’s take a look.

Equipment Leasing for Craft Breweries

Purchasing specialized equipment for a brewery can be cost prohibitive. Instead of taking starting out too small or settling for sub-optimal aftermarket equipment, breweries can use equipment leasing to buy what they need.

By leasing equipment, craft and microbreweries get the equipment they need at affordable monthly installments, retain control of the equipment, and generally take ownership after the lease ends. New and used equipment can be financed.

SBA Term Financing for Craft Brewery Growth

Some SBA preferred lenders specialize in lending to the craft brewing industry. Terms out to 10 years are available for non-real estate financing and out to 25 years if the loan includes the acquisition of real estate to house the brewery. Tenant improvements, equipment and inventory can all be financed through an SBA 7a loan for your brewery.

Unsecured Business Lines of Credit for Craft Brewery Working Capital

When starting up a craft or microbrewery, entrepreneurs need a reliable source of working capital for small purchases. Unsecured business lines of credit are available for new and small businesses, so brewers do not have to put up any collateral to bolster their purchasing power.

There’s a caveat to this approach! As long as you are able to pay off this line of credit in a timely way, this type of unsecured financing could work for your start up strategy.

Questions? Schedule a call now!

Real Estate Financing for Craft Brewery Property Acquisitions

Successful breweries often outgrow their initial leased space and look to purchase property. Loans guaranteed by the SBA can be excellent options with maturities out to 25 years. We work with several lenders that specialize in financing these types of owner-occupied properties.

Non-SBA acquisition and real estate construction/rehab financing is also available for established breweries looking to acquire property for business use.

Accounts Receivable Financing to Improve Brewery Cash Flow

Customers who order in bulk from breweries usually take 30 days or longer to pay. Waiting for customers to pay places a strain on cash flow. Accounts receivable financing for brewery sales turns open invoices to cash quickly, and reduces the reliance on term financing.

Most of the financing requirements of growth-focused craft and microbreweries fall outside the loan programs offered by traditional lending. Speritas Capital Partners has some creative financing solutions for you to consider. Would you like to discuss your long term goals for your brewery and see what type of financing would be the best strategic fit?

Schedule a call with the author, Jeff Bardos, send an email, or call/text him at 203-247-4358.

Just doing research on launching a craft brewery or taproom? Read our article on “Starting a Craft Brewery: 9 Things to Consider“.

About the Author

Jeff Bardos, CEO, Speritas Capital Partners

As a veteran home brewer I know how hard it is to produce a good beer! So far I only share my efforts with my poker buddies. My skills as a debt advisor are arguably better than my brewing skills, which is unfortunate for the poker group, but good for craft brewers! And now for a shout out to one of my favorite breweries, Tuckerman Brewing in North Conway, NH – try their Pale Ale, available in NH, MA & ME.

Jeff has over 30 years of experience in the financial services industry and over 12 years of sketchy home brewing in his basement. After graduating from the Columbia Business School, he joined the New York Federal Reserve Bank as a senior staff member in Bank Supervision, leading the Bank Analysis department. From the nation’s central bank, Jeff moved into the private sector, working at senior levels in commercial banking, retail banking and risk management. He has also played senior founding roles in several start-ups. Learn more about Jeff.

CONTACT INFO

Jeffrey Bardos

CEO Speritas Capital Partners

Call/text Jeff at 203-247-4358

Email Jeff with your brewery financing questions

Schedule a call with Jeff using our online scheduling tool.

Speritas Capital Partners specializes in complex credit, collateral and cash flow situations and we never take upfront fees.

Because Speritas Capital is a debt advisory firm, we have access to a wide variety of lending structures. We’re not beholden to any one lender or structure so we can use our creativity and experience to design a structure that truly fits the needs of our clients.