Articles by Speritas Capital

How To Choose a Commercial Loan Broker You Can Trust

Finding the right lenders for your financing needs takes a lot of time and effort. That’s why many businesses consult a commercial loan broker to find funding.

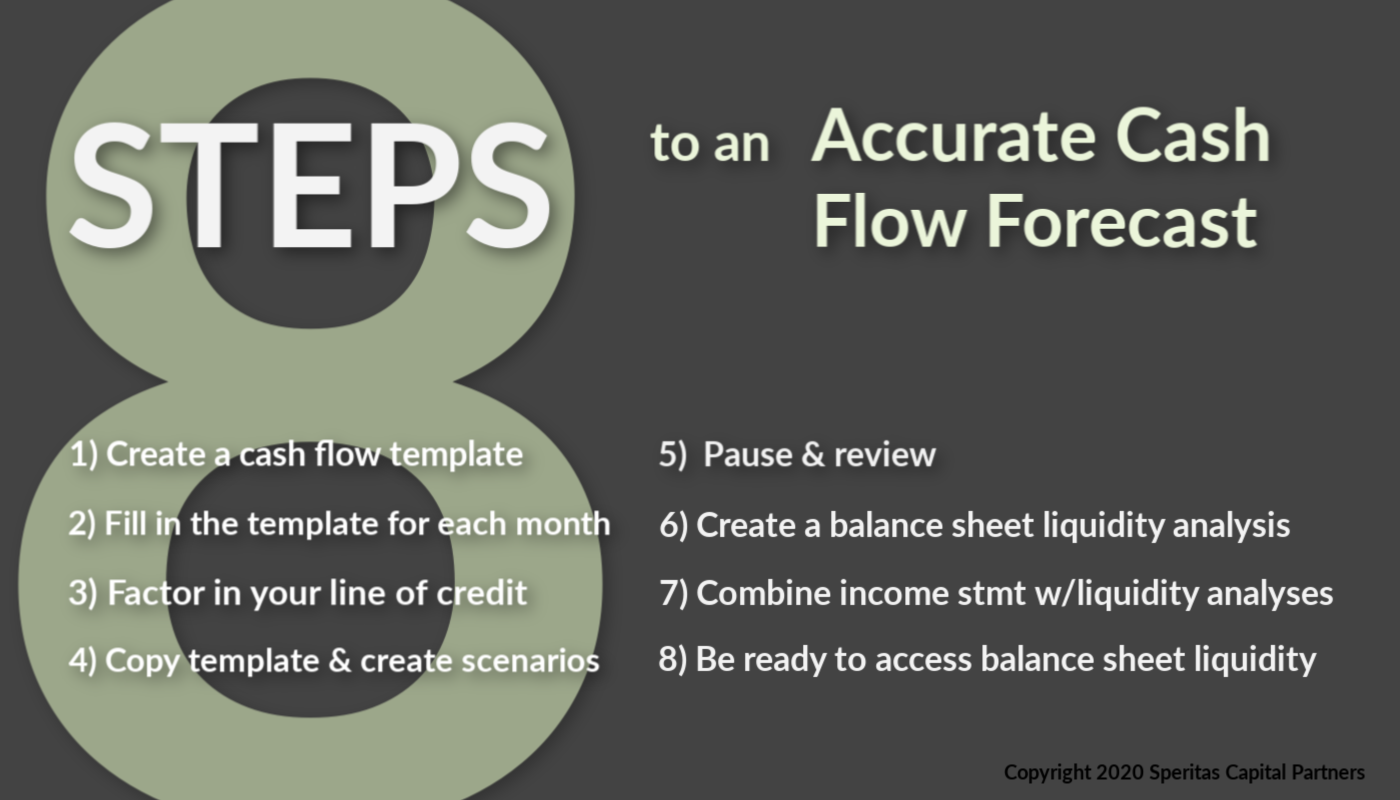

How to Manage your Liquidity: 8 Steps to an Accurate Cash Flow Forecast, with Template

How can strong liquidity forecasting and liquidity contingency planning help your business survive? Creating a cash flow forecast is critical for lenders, AND helps you plan for liquidity events.

The Pros and Cons of Accounts Receivable Financing

There are many advantages to using Accounts Receivable financing to fund your company’s growth, but there are also some perceived cons. Let’s dig in!

New Haven CT Healthcare Business Financing

Anchored by the Yale New Haven Health System, the medical school & entrepreneurial centers at Yale University, New Haven is a mecca of healthcare business innovation and growth center.

Four Reasons Small Businesses are Important to the Local Economy

Big businesses may seem to form the bedrock of the US economy and wealth creation, but in reality small businesses are more important to the ‘very’ local economy.

What is a Sources and Uses Table in Commercial Lending & Why do you Need One?

When you’re acquiring a business or purchasing commercial real estate, a sources & uses table helps you organize all the cash inflows & outflows. Lenders (including the SBA) expect to see this.

Have You Considered an SBA 7a or SBA 504 Loan for Your Next Equipment Acquisition?

Why should small businesses consider SBA 7a and 504 loans as an option for their equipment financing needs? SBA loans offer lower costs, longer maturities and higher leverage.