How to Manage your Liquidity: 8 Steps to an Accurate Cash Flow Forecast, with Template

By Jeff Bardos, CEO Speritas Capital Partners

June 19, 2020 – Greenwich, CT

Call or text 203-247-4358

Schedule a call with Jeff

Email Jeff

Portions of this article were originally published in Newsline, the Magazine of the National Equipment Finance Association, May/June 2020 issue, page 22.

“The severe economic impact of COVID-19 has reinforced the old adage that ‘cash is king’ and liquidity contingency planning is essential” Jeff Bardos

Businesses with sufficient cash to weather liquidity events stand a better chance of survival. And those with strong liquidity contingency planning and liquidity forecasts stand the best chance of having the cash to survive any crisis.

How many businesses, including equipment finance companies, had liquidity contingency plans in place at the start of the pandemic? Not enough, apparently.

Best-in-class liquidity management incorporates both the income statement and the balance sheet in a two part process.

Analyzing the timing of cash inflows and outflows is one part. The second part is understanding what assets, including equipment, can be financed or refinanced to extract working capital.

This integrated approach is not easy – good accounting systems can help – but any business can create a useful liquidity forecast and contingency plan.-

COVID 19 impacted revenue more quickly and significantly than most people could have anticipated.

As owners, managers and CFOs emerged from this crisis, they’ve begun to evaluate their financial flexibility going forward. Actively enhancing and developing cash flow forecasting and liquidity planning tools are the keys to managing (and surviving) the next crisis.

Lack of liquidity drives more businesses into bankruptcy than insolvency.

So what is liquidity planning and how do you start?

Simply put, liquidity planning is cash flow planning that combines the cash flow from revenue and expenses with the potential cash flow on your balance sheet.

This is a standard tool used by restructuring professionals at the beginning of every engagement. A business being restructured needs to know how long it can survive before seeking bankruptcy protection.

In some sense, the pandemic forced all businesses to face ‘restructuring’ and to confront the need for liquidity management.

The starting point for liquidity management planning is a good cash flow template and reasonable scenarios. This step-by-step guide to building a plan is a good place to start.

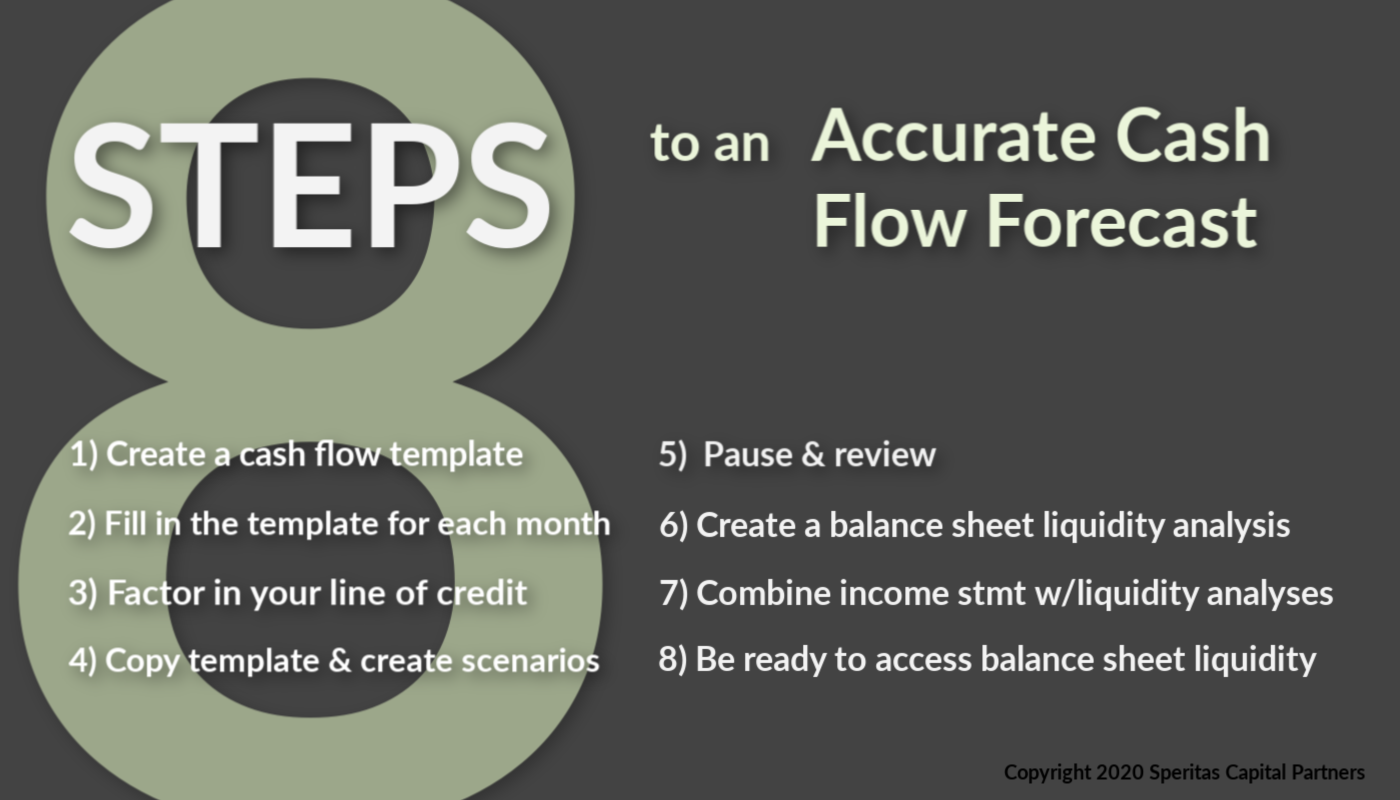

A Cash Flow Forecast in 8 (relatively simple) Steps

Step 1 – Create a cash flow template, see sample below

The columns of the template represent each upcoming month, starting from today and extending out 12 months. The rows of the template are cash inflows and cash outflows.

Cash inflows are accounts receivable collections and other expected cash receipts.

Cash outflows are operating and capital expenses which you can categorize as mandatory (to support sales, production, staff, repairs and maintenance), discretionary (cap ex, maintenance which could be deferred, professional fees) and financing costs.

Once you’ve entered the inflows and outflows you need to calculate the change in your net cash position and you need to keep a running balance of your expected cash at the end of each month:

Step 2 – Fill in the template for each month.

Assuming business as usual (BAU), slot in your expected cash inflows and outflows in each month. Make sure the monthly cash balance is calculated.

Step 3 – Factor in your line of credit.

If you have a line of credit, draw on it to zero out negative cash balances in any period. Track your line of credit balance against your maximum line amount or maximum availability if an ABL line.

Step 4 – Copy the cash flow template and create scenarios.

Repeat steps 2 and 3 for a moderate or prolonged downturn and for a sharp and quick downturn. Spend some time thinking through the implications of each scenario.

On the inflow side, focus on which customers are likely to delay POs or payments. On the cash outflow side, look at which vendors might shorten payment terms and which ones you can stretch out.

Review how you could streamline production, reduce inventory or overtime to conserve cash in these scenarios. Analyze what scheduled maintenance could be deferred.

Consider whether your ABL lender could limit availability in stressed times.

Step 5- Pause and review.

Take a critical look at each scenario for completeness and reasonableness. Highlight months where cash balances turn negative. Look at the percentage of the total line availability you would have to draw in each month.

Cash position at the end of the month = monthly starting cash position + cash inflows – cash outflows.

Questions? Schedule a call with the author, Jeff Bardos, email, or call/text him at 203-247-4358.

Step 6 - Create a balance sheet liquidity analysis.

The template for this analysis has 4 columns: (Not pictured in this article!)

Column 1 is your latest balance sheet showing all major asset categories.

Column 2 is how much liquidity is provided by each asset category based on current financing arrangements. Calculate the maximum amount of borrowing possible against AR, inventory, machinery and equipment, real estate and IP. Read our overview of asset-based lines of credit to learn more about how to use an asset-based line of credit to generate liquidity.

Column 3 is potential liquidity from each asset type. Answer the following questions:

Could you leverage other collateral on your balance sheet?

Could another lender provide more collateral eligibility and/or higher advance rates on your leveraged collateral?

Is there any used equipment or real estate that could be financed or sold?

What about a sale leaseback on your equipment?

Could you use subordinated debt secured by hard assets or even personal assets?

Would other lenders consider patents or other IP in the collateral pool?

What are the prepayment penalties for each loan/lease on your books?

In Column 3, enter the maximum amount of potential liquidity available from each asset class.

Column 4 - Subtract Column 3 from 2 to get an indication of the incremental or untapped liquidity available from your balance sheet.

Step 7 - Combine the income statement and balance sheet liquidity analyses.

Think through where incremental balance sheet liquidity could be applied to negative cash positions in any of the liquidity scenarios.

Step 8 - Get yourself in a position to access balance sheet liquidity as quickly as possible.

What does that mean? For machinery and equipment, make sure you have a detailed and up-to-date fixed asset ledger including capex. This will enable productive conversations on equipment finance or equipment sales.

Identify equipment, ABL, CRE or other lenders to whom you could reach out if you needed to go beyond your current lender relationships.

Would you know where to turn for equipment finance or equipment sales? Prudent liquidity management includes maintaining a list of lenders and trusted brokers with their contact information.

Even in good times, liquidity planning is important. Part of a business’s quarterly review should include a discussion of the liquidity forecast.

The Finance Department should compare actual cash balances with the forecasted balances. Variances from the forecast should be analyzed and used as input for future forecasting.

Liquidity Plan Triggers

When I worked in Corporate Treasury for a top 10 commercial bank, we had a list of liquidity contingency plan triggers – events that required a heightened review of the bank’s liquidity at the highest management levels.

Triggers included negative news, weaker earnings, or loss of a major customer. These events required management to meet and review the liquidity contingency plans on a more regular basis, possibly daily if things became dire.

Management should identify the triggers that relate to their business and have an internal communication protocol to alert senior management when one of the triggers has occurred.

Liquidity contingency planning takes some heavy lifting up front but it can lead to greater financial flexibility and much better outcomes in times of stress.

We don't know exactly when, but we do know that there will be another crisis. Will you be ready?

A portion of this article appeared in the May/June 2020 issue of Newsline, the magazine of the National Equipment Finance Association (NEFA).

Liquidity planning & cash flow forecasting can be complicated and it’s easy to make small errors that impact your fundability during a crisis. Speritas Capital is here to help you think through your analysis & assess your funding options.

Schedule a call with the author, Jeff Bardos, email, or call/text him at 203-247-4358.

About the Author

Jeff Bardos, CEO, Speritas Capital Partners

Jeff has over 30 years of experience in the financial services industry. After graduating from the Columbia Business School, he joined the New York Federal Reserve Bank as a senior staff member in Bank Supervision, leading the Bank Analysis department. From the nation’s central bank, Jeff moved into the private sector, working at senior levels in commercial banking, retail banking and risk management. He has also played senior founding roles in several start-ups. Learn more about Jeff.

CONTACT INFO

Jeffrey Bardos

CEO Speritas Capital Partners

Call/text Jeff at 203-247-4358

Email Jeff with your financing questions

Schedule a call with Jeff using our online scheduling tool.

Speritas Capital Partners specializes in complex credit, collateral and cash flow situations and we never take upfront fees.

Because Speritas Capital is a debt advisory firm, we have access to a wide variety of financing structures. We’re not beholden to any one lender or structure so we can use our creativity and experience to design a financing structure that truly fits the needs of our clients.